Gas Price Hedging

Gas prices have been high for the last couple of weeks. Because I drive a lot, such things are significant. It would seem possible to construct a "gas price hedge" somehow, in order to reduce the risk of changing gas prices. I haven't figured it all out yet, but I have found some interesting data, and ran some studies.

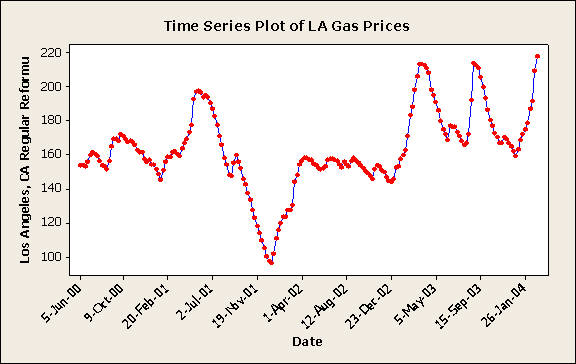

The graph below shows Los Angeles gas prices, since mid-2000. The data was taken from a Department of Energy website.

There are a couple of ways of building a hedge. One way is to stocks whose returns have a high correlation with gas price changes. (The scenario becomes: If gas prices rise, then the my gas expense goes up. However, my stock portfolio will go up, too, so I come out even.) Another way is to use options to find a risk-neutral portfolio. It would work in a similar way, but options are guaranteed to have perfect correlation. I decided to start by looking a stocks, simply because I am more familiar with the format of the data and the means of purchasing stocks.

I decided to look at a couple of oil industry stocks (BP, Exxon, and Halliburton), as well as some stock indexes (S&P 500, and the Dow Jones transportation index, which may have a negative correlation). Historical data can be obtained from Yahoo Finance. I then computed returns (log-based) for each week, and computed a correlation matrix (with computed changes in gas price, from the data above).

|

|

Gas Change |

XOM Change |

HAL Change |

BP Change |

LUV Change |

DTX Change |

|

XOM Change |

0.038 |

|

|

|

|

|

|

p val |

0.594 |

|

|

|

|

|

|

HAL Change |

0.112 |

0.379 |

|

|

|

|

|

p val |

0.12 |

0 |

|

|

|

|

|

BP Change |

-0.043 |

0.737 |

0.404 |

|

|

|

|

p val |

0.553 |

0 |

0 |

|

|

|

|

LUV Change |

-0.089 |

0.309 |

0.028 |

0.229 |

|

|

|

p val |

0.217 |

0 |

0.697 |

0.001 |

|

|

|

DTX Change |

-0.116 |

0.439 |

0.158 |

0.384 |

0.658 |

|

|

p val |

0.107 |

0 |

0.028 |

0 |

0 |

|

|

SPX Change |

-0.083 |

0.554 |

0.304 |

0.561 |

0.532 |

0.745 |

|

p val |

0.252 |

0 |

0 |

0 |

0 |

0 |

The correlation matrix is somewhat surprising. Changes in gas price really don't seem to be strongly correlated with any of the stocks that I looked at. (The p-values for the correlation seem to be kind of high, too, so it could not be argued that any of the correlation coefficients are statistically significant!)

Another thought was that changes in gas price might lead or lag stock price changes. To investigate this, I computed the cross-correlation coefficients between gas price changes and BP price changes, for lags between -23 and 23 weeks (a negative lag means that the stock price rises before gas price rise, and a positive lag means that the gas price rises before the stock price).

The hypothesis is weak, at best. There was some significance at lags of -3 weeks and -5 weeks, but it was on the boarder of 90% significance. Still, it is interesting to note that BP's stock seems to go up about a month before gas prices rise (and, similarly, go down about a month before gas prices fall).

The correlation matrix, though, was an important finding. Due to the lowness of the correlations, the stocks investigated do not seem to be good candidates to hedge gas expense risk. I will have to look at options and other derivatives. (This is good, because it will give me an excuse to find about a financial instrument that I haven't had to deal with much yet.)

Comments

Jeff -- when you are done with this study let me know. I'll give you a contact in the Integrated Supply and Trading unit of BP and you can find out the answers! As you might guess, these types of relationships are the "bread and butter" of people who are buying and selling petroleum products around the world.

Your correlations -- which essentially show that gasoline prices in LA are random in relation to the price of Oil stocks -- de-bunks one of the politicians' favorite ploys, i.e., the gouging oil barons! If we (for those who don't know, I work for BP) were keeping gas off the market in order to raise prices artificially, that would mean our intent was to get our stock price up, right? Why else raise our profits? We don't pocket the money personally.

But as you have proven, the world is a bit more complicated than that. Our stock prices just aren't that sensitive to the LA gasoline market. I know that's a bit blow to the Los Angeleno ego, but you'll learn to live with it.

Now if you could predict when one of the 9 or 10 refineries on the West Coast that make your famous CARB fuels is going to break down, you could really make a fortune. But that would not be hedging per se.

But this does give you something to occupy your time while Elizabeth is in Hawaii. Keep searching.

Posted by: Tom Standing | March 27, 2004 12:30 PM

OK Jeff....brace for another spike in gasoline prices in LA. Shell Oil's refinery in Wilmington (somewhere in the LA area) is having problems with it's coker; we (BP) are still doing maintenance on a hydrotreater at our Carson location (down toward Knott's Berry Farm); Valerjo Refining's plant (also in Wilmington) is also doing maintenance. So there must be a real crunch in supplies for the CARB fuels that Californians crave. Maybe you should buy stock in the LA Transit Authority as a hedge?

Posted by: Tom Standing | April 5, 2004 09:21 AM

Jeff,

Good info. I am currently putting together a business plan for a business that would allow consumers to hedge gas prices utilizing a web based interface. Your information is helpful.

Posted by: Randy | March 28, 2008 06:43 AM